A fourth of Pune’s shopping malls remain empty though that’s an improvement over the 27% vacancy levels seen in the last two quarters. With supply at a standstill, retailers are once again signing up for space. However, the relief might be temporary since fresh supply is on its way; Westend Mall with 3,50,000 sq.ft. space in Aundh and Spot 18 with 1,50,000 in the Pimpri-Chinchwad region—are slated to open soon.

In the meanwhile, the exits continue for MNCs like Marks & Spencer, French retail chain Auchan and others. Mariplex, a 90,000 sq.ft. shopping centre in Kalyani Nagar is to be converted into a food and beverage area while the one lakh sq ft Jewel Square, in Koregaon Park will now house offices. Others have been less fortunate; Koregaon Park Plaza, is said to be on the block.

A about 5,00,000 sq.ft. mall owned by an Israel company Elbit Imaging Ltd through Plaza Centers India, has seen a series of exits, beginning with one of its anchor tenants Shoppers Stop that left after a fire in the mall in 2012. Following this, retailers like Croma, Reliance Trends, etc. have also left their spaces in the last one year.

Among some large recent transactions in Pune, 18,000 square feet has been picked up in Nucleus Mall on MG Road in Pune which has been across 2,00,000 sq ft.The lessee is Jade Blue, which manufactures and retails men’s apparel. Jaihind Collections, a local men’s clothing brand too will set up shop here across 15,000 sq.ft.

Given that in 2013, Shoppers Stop, one of the anchor tenants occupying 30,000-35,000 square ft pulled out, followed by a string of other retailers, this is good news for mall owners. Pune had become a mall owner’s night mare with supply far outstripping demand; between 2011 and 2013 close to 6 million square feet space across four — malls Phoenix MarketCity, Amanora Town Centre, Koregaon Park Plaza and Seasons Mall — was opened.

Suppy clearly exceeded needs of the population of around 62 lakhs; brands like Shopper’s Stop, Croma, Reliance Trends and Reliance Digital pulled out from various malls one after another.

As Anand Sundaram, CEO, Pioneer Property Zone, a mall management company points out, such a large supply of mall space in a city which had never had access to organised retail, and that too in a matter of 700 days, was unwarranted. “Consumption was clearly far lower than anticipated,” Sundaram observed.

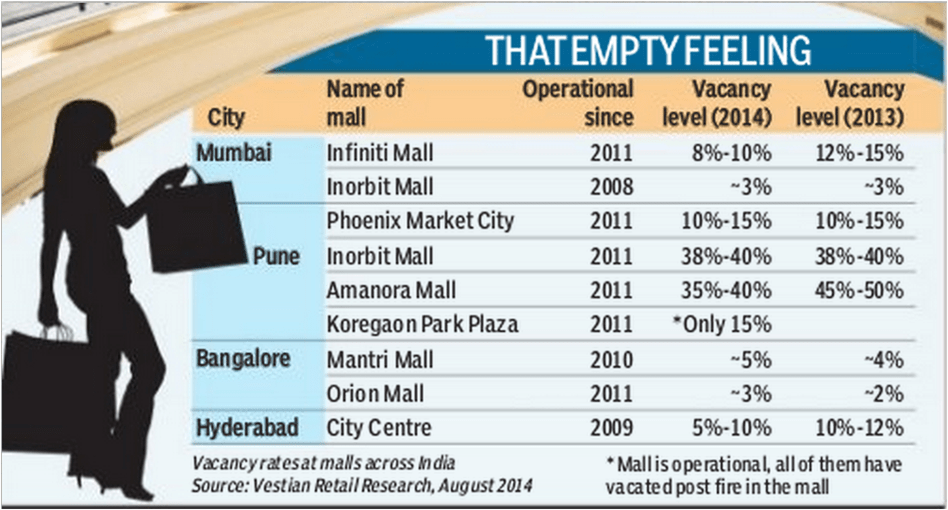

Some pockets like Nagar Road, which saw a sudden influx of mall space with Inorbit creating 5,47,000 sq ft, Pulse Mall with 2,20,000 sq ft, and Phoenix Market City with 1,15,0000 sq ft continue to see high vacancies. Inorbit, for example, is still 40% vacant, data shared by Vestian, a global real estate advisory firm show. However, Amanora and Seasons Mall, which opened opposite each other in the Magarpatta area of Pune, and were doing badly in terms of occupancy, are now slightly better off. Amanora, which was half empty till last year, is 40% vacant. “Pune consumers will be looking to spend on superior lifestyle and fashion and that’s probably why occupancies are slowly climbing,” says Sundaram.

(Source: http://www.financialexpress.com/news/mall-space-in-pune-goes-abegging-a-fourth-is-vacant/1289141/0)